Irs Form 709 (Gift Tax Return) 2023-2024

Show details

Hide details

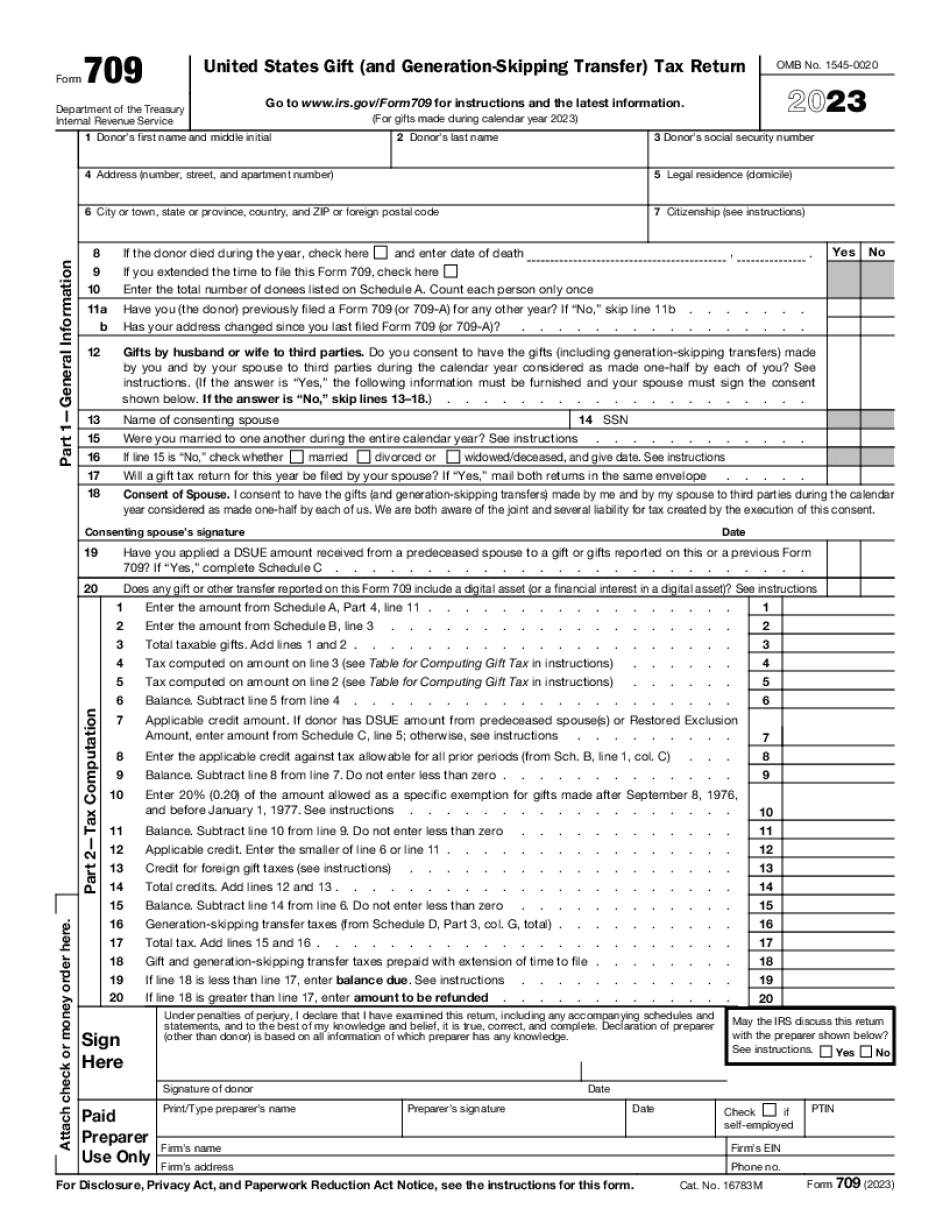

Transfers in trust see instructions Does the value of any item listed on Schedule A reflect any valuation discount If Yes attach explanation B. 2 Donor s last name 3 Donor s social security number 4 Address number street and apartment number 5 Legal residence domicile 6 City or town state or province country and ZIP or foreign postal code 7 Citizenship see instructions Yes If you extended the time to file this Form 709 check here Enter the total number of donees listed on Schedule A. United ...

4.5 satisfied · 46 votes

form-709.com is not affiliated with IRS

Filling out Form 709 online

Upload your PDF form

Fill out the form and add your eSignature

Save, send, or download your PDF

A complete guideline on how to Form 709

Every person must report on their finances in a timely manner during tax period, providing information the Internal Revenue Service requires as accurately as possible. If you need to Form 709, our trustworthy and intuitive service is here at your disposal.

Make the following steps to Form 709 promptly and efficiently:

- 01Upload our up-to-date form to the online editor - drag and drop it to the upload pane or use other methods available on our website.

- 02Check out the IRSs official instructions (if available) for your form fill-out and attentively provide all information required in their appropriate fields.

- 03Fill out your template using the Text tool and our editors navigation to be certain youve filled in all the blanks.

- 04Mark the boxes in dropdowns with the Check, Cross, or Circle tools from the tool pane above.

- 05Make use of the Highlight option to accentuate particular details and Erase if something is not applicable any longer.

- 06Click the page arrangements key on the left to rotate or delete unwanted file sheets.

- 07Verify your forms content with the appropriate personal and financial paperwork to make sure youve provided all details correctly.

- 08Click on the Sign tool and generate your legally-binding eSignature by adding its image, drawing it, or typing your full name, then place the current date in its field, and click Done.

- 09Click Submit to IRS to electronically send your report from our editor or select Mail by USPS to request postal document delivery.

Select the simplest way to Form 709 and report on your taxes online. Give it a try now!

G2 leader among PDF editors

30M+

PDF forms available in the online library

4M

PDFs edited per month

53%

of documents created from templates

36K

tax forms sent over a single tax season

Read what our users are saying

Learn why millions of people choose our service for editing their personal and business documents.

What Is Form 709?

Before you start creating a 709 Form sample, you need to check if you have to. Note that not each transfer requires payment of taxes. Here you will find the list of cases when a blank is needed:

- 01you gave gifts to someone totaling more than $14,000 (other than to your spouse);

- 02you made transfers called future interests;

- 03you need to split gifts with your spouse;

- 04you gave property held by both you and your spouse;

- 05you are an individual only.

If you fall within one of the above-mentioned categories, you have to fill out a blank and file it with the IRS.

The fillable template is a one-page document that comprises two parts. To create it saving time and effort we offer you to try an editable blank that can be prepared online in minutes. Save a completed file to your device or print out in no time. Find below the details you need to furnish:

- 01general information (donor`s name, address, citizenship, SSN, marriage details, date of death etc.);

- 02tax computation.

The document also includes four schedules that should show information about real estate or money transferred.

A final Irs 709 paper must be signed by a donor or his/her spouse. Sign a document electronically by typing, drawing or capturing your signature with a webcam.

Online remedies enable you to arrange your doc management and supercharge the productiveness of your workflow. Go along with the short information as a way to full Form 709, stay clear of problems and furnish it in a well timed method:

Questions & answers

Below is a list of the most common customer questions.

If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is the purpose of Form 709?

In a nutshell, the purpose of Form 709 is to be able to quickly file information returns and claim certain tax benefits. These provisions have two main purposes:

1) To ensure the tax benefits and other services to the government were actually provided

2) To ensure that tax was paid on the correct payments made to the tax preparer

The IRS uses Form 709 to verify the accuracy of data supplied on W-2's used to calculate tax due on the payee(s) of the form and to verify whether the tax paid was the correct amount paid by the payee. An employer or payee can use this form in their own information returns.

To properly file Form 709, be sure to:

Familiarize yourself with the IRS publication Tax Topic 406, IRS Publication 6041, Business Expenses and the U.S. Treasury's publication Internal Revenue Manual (IRM).

Review IRS Form 8606 and Form 8812, Statement on Transfers of Assets and Specification of Tax.

In the event that a taxpayer has changed their address, the information required for Form 709 should be filed using the new address.

Is Form 709 still valid for business taxes?

Yes. In order to provide the same protections and benefit that the IRS provides to taxpayers with information returns, a change of business structure, use of a different mailing address, or the use of another method for payment and reporting as needed, taxpayers are still eligible to use the same payment methodology and reporting as for a tax return.

Taxpayers will need to use Form 709 to verify the accuracy of their W-2 data at various points in the tax filing process to allow the IRS to make sure the payment is valid and that the payee does have the correct tax due. The IRS can also use Form 709 to verify that tax is paid by the payee and not on the tax preparer.

The IRS maintains the W-2 system to protect the IRS from fraud, identity theft, and to make sure that the government is being paid on time. While the W-2 system is the IRS's largest payment system, it is still the taxpayer's responsibility and responsibility to ensure that the required information is provided on the proper form and is not misreported. As part of reporting to the IRS, it is the payee's responsibility to ensure and keep their W-2's current and accurate.

Who should complete Form 709?

Please complete Form 709 if the following apply:

You are age 65 or older, and you are no longer eligible for Medicare.

The date of separation from service was before July 1, 2014.

Your separation was at least 50 calendar days after the due date of your pension. If you do not provide the date of separation, or if you do not provide a letter from the Pension Board, pension benefits will be reduced. To know when you became entitled, contact the Pension Board at 800.821.9100.

You received a military separation in the armed forces or other federal agency (such as the FBI or the Coast Guard).

Your separation was at least 25 calendar days after (or before) the due date of your pension. For example, if you are age 65 or older, and you are separated on July 1, 2013, and you are eligible for a pension for retirement, you will be granted a retirement benefit as follows: 25 calendar days — if you are paid into the system on or after July 1, 2013, you will receive the benefit as of your due date.

50 calendar days — if you are paid into the system prior to July 1, 2013, you will receive the benefit on or after May 18, 2014; and

75 calendar days — if you are paid into the system prior to July 1, 2013, you will receive the benefit on or after March 1, 2015.

To be considered for the military retirement component and be eligible for the pension, you must be separated on or after July 1, 2014. To be considered for the other pension component, you must be separated prior to July 1, 2014, and you must have been separated at least 50 calendar days after (or before) your separation date.

Important: Make sure you fill out the information in the correct order. Only complete Form 709 when asked if you want to start receiving a pension or will receive a pension.

Do I have to repay my annuity?

Yes, you have to repay any military separation annuity you receive. If you have an individual retirement account (IRA), you can deposit that money into that account before you file your Form 6251. You could also use an IRA to start taking an income tax deduction.

When do I need to complete Form 709?

You will need to file Form 709 by April 15 of each year. If your business or trade name is not available, there is a time period starting with the year you file and ending with the year it is submitted.

The current guidelines for filing Form 709 are as follows. You can find more information at IRS.gov, along with a checklist to help you prepare your forms.

Can I create my own Form 709?

I have read several articles on your website about Form 709 instructions. However, I have yet to see any information regarding how to create a 709 using the instructions on your website.

There are several ways to create your own Form 709. Please contact us for assistance.

What is considered taxable income?

How soon will I receive my Form 709?

Is this the same as a non-business, non-profit, non-resident return?

What if I need to update my return for the year?

What if I have other income (like dividends and interest) that is excluded by the Code?

Are there other income limitations that may apply?

Do I need to file as a sole proprietor, partner, or both?

What happens if I am not required by statute to file a return?

Is there a penalty?

Other questions about Form 709

Does the U.S. Treasury keep track of Form 709s filed in your city, state, country?

How do I know if my refund has been issued or how long before it will be due?

How do I calculate the amount that I owe on a return?

If I file Form 709, does it mean I'm filing on Form 1040 or Form 1040A?

How do I file Form 709 if I am a non-resident but have a U.S.

What should I do with Form 709 when it’s complete?

You can use Form 709 as it was originally prepared if it was issued and paid for by a government agency (such as an IRS office, or in a tax return), the return was filed using electronic filing methods, and you are not eligible to amend it.

As described above, you can file a claim for an amended return using Form 709, but you will need to complete a Form 7719 (Form 709 to Amend Claim for Refund) at the same time. You can download Form 7719 from the IRS website.

Can I get Form 709 amended later?

Yes. If you are eligible to amend your Form 709 for the same purpose for which you originally filed it (i.e., you were not eligible to amend it based on a different IRS procedure), you can amend Form 709 by completing Form 7719 and filing it with your original Form 709.

How do I get my Form 709?

I got a question, what is Form 709?

Form 709 is one of ten documents required for U.S. expatriates. The fee is 100 for individuals and 250 for corporations. An annual renewal is required. The form is mailed to the address on file. Renewals are typically done between January and March. The form is signed by the U.S. government and will not be returned by mail. You will still need to pay other fees unless you have submitted an emergency petition with U.S. Citizenship and Immigration Services (USCIS). Renewals can also be requested online at. The renewal fee is 50 per year, and is reduced if the petition is approved. If you are unsure of where to submit the renewal, do not hesitate to contact the U.S. Citizenship and Immigration Services office at.

Form 709 can only be completed by the taxpayer, either individually or with a notary. If you complete the form at a notary's office, the notary will return it to you. The address and telephone number are provided with the form. Make sure to take the form with you when you are required to file.

Can a Form 709 be renewed?

Yes. We encourage everyone to renew the Form 709 every year. Renewal fees are waived when the petition is approved by USCIS, and the taxpayer has paid the fees for the current tax year. Otherwise, you will have to pay USCIS the same fee as shown below for the current and subsequent year. If the taxpayer has paid the taxes of two consecutive years, the fee increases to 25, and if three or more consecutive years have been prepaid, the fee also increases to 45.

If I filed a previous extension, my Form 709 will need to be renewed?

Yes. Once the taxpayer is issued a new passport, it is important for the expatriate to complete the new Form 709 each year in order for immigration to be processed by USCIS. Once you have filed the Form 709 for the previous year, a regular renewal is required. The fee is the same as shown above.

Once the Form 709 is renewed, does the expat still owe federal income taxes?

Yes, all income taxes must be paid by February 15 of the tax year in which the Form 709 is issued.

What documents do I need to attach to my Form 709?

You need to send in any documents that are related directly to your employee (for example, pay stubs, expense receipts, etc). But what if I didn't send in any of those? If this is the case, you will need to attach your pay stubs and/or records of all the expenses that you paid for that employee.

Do I still need to pay taxes on the employee's wages?

Yes! The IRS requires you to pay taxes on any income that you provide that is exempt from federal income tax and paid to an employee. This includes income from commissions, overtime, bonuses, salary, tips, and vacation pay that is exempt from federal income taxes.

What if I can't pay the employee in full?

If you can't pay the employee, the IRS will take money from your gross wages as part of the employee's Social Security contributions. If you are unsure how much money is owed, ask your employee. Also, if you fail to pay a worker the proper amount of compensation and wages, the worker can sue you. If that occurs, you could end up in significant court exposure if you can prove that you were not honest with the worker.

What if I don't think I could pay the employee?

You may be able to change the job to another type of work. For example, if the employee needs to be treated for a physical disability or needs leave from the job at a certain time of day, the employee can ask you to help in arranging for the change of employment.

What if the worker wants me to pay the employee back?

If a worker wants you to pay the employee the proper amount of compensation and wages, he or she must show that the employee needs the money to support himself or herself, so that you will not be punished by a court.

If I don't know whether my worker wants to return my wages, how do I determine that the employee does?

The IRS provides guidance on determining whether a given worker needs the compensation to support the worker or him or herself. For example, if a worker is a single parent, the worker need more than 750 per month just to meet his or her own basic needs. For additional information about determining that a worker needs compensation, refer to Publication 587, Wage-Hour Employer's Guide.

What are the different types of Form 709?

Where can a form be filed?

Form 709 is a request for information filed with IRS. It is required whenever an individual has income sources in more than one tax jurisdiction — foreign or domestically.

There are three forms of Form 709.

The most common Form 709 is the “W-9.” The W-9 is the electronic form that you file with your employer. While Form W-9 is the most common, it isn't the only form that you must file with your employer.

You can also file another form if the income from your business or profession provides a U.S. source. A U.S. source is any source derived directly or indirectly from any U.S. person, including corporations, partnerships, limited liability companies or estates.

You can also file a Form 709 for each source of income that you receive in a taxable year, but the first one must be filed. Any tax due after the first form filed can be paid using the self-employment tax return.

For more information, see Publication 2107, U.S. tax form; Publication 519, Miscellaneous Income, and Publication 718, Taxable and Nontaxable Income, or visit our Forms and Publications section.

Form 1040F and Form 1040NR include the following information:

Forms filed with the IRS, such as Forms 709, may require the use of the “Self-Employment Tax” form, available in the Download center.

The W-8GES is not required with any Form W-9, W-8G, Q-4, or 1099-MISC, but Form W-8 can be filed with that form with certain exceptions. It is not necessary for most individuals to file an amended return with the IRS if an W-8 is not filed on your last return. If an amended return is filed, you do not have to complete and attach a modified return.

Forms 709 are generally only issued by employers, but there are also employers who file for Forms 1099-INT, which are issued by third party service offices. These forms may be useful if a customer contacts a retailer, for example.

How many people fill out Form 709 each year?

In 2013, the IRS issued 1.37 billion in refundable tax credits to individuals who filed for tax returns. The Form 709 refund program paid out 2.1 billion. There were more than 20 million individual income tax returns that received a refund from the Section 179 expense deduction and Section 25D interest deduction in 2013.

The IRS estimated that more than 1 million individuals received two separate 2,500 refunds on the same tax return.

Where can I get more information on Form 709?

Follow IRAs on Twitter at IRAs org

Find more information on Form 709 on IRS.

Is there a due date for Form 709?

We'll send you a follow-up e-mail with details of your tax return processing and will also issue a Form 709 for your records. Please provide this when completing the “Filing a tax return” portion of the Form 760.

How do I file my business return?

Your return for the year, as filed with the U.S. Internal Revenue Service must be filed on the next business day after the Form 760 was received. You should take this into consideration when filing the tax return. If you file your return on January 31 or earlier, the tax will be withheld from your paycheck on that date. Be sure to file your return on the following Monday for the year in which your payment is due.

What if the return is delayed?

If you are unable to file your tax return due to a delay in payment, or you file late or don't file at all, it may affect your credit for that year. For more information about the due date for filing Form 760, go to the “Filing a tax return” subsection of the Schedule E.

What if I receive less than my payment?

You may receive less than your money, but it will not take you to the back of the line. The U.S. Internal Revenue Service will adjust the amount due as necessary.

How long does it take to close my account?

As a courtesy to clients of The IRS, we ask them to provide us with the date it is due. However, if you are unable to provide us with this information by the due date, you can mail the due documentation within seven (7) working days of receiving it. Once your documentation is received, we will close your account as soon as possible.

What is the difference between a “payment” and a Form 709?

There is a certain amount by which the IRS must complete the Form 760 before there is a final action. The amount of money that has to be received is known as the “due date for return to be filed.” However, once the taxpayer has provided the required information in the past and made the payment, the amount due is no longer a factor. The IRS then prepares a Form 760 and the payment is processed.

If I am a taxpayer paying by credit card or other payment method, am I entitled to a rebate on the tax?

You are not entitled to a rebate of tax paid by credit card or other methods of payment.

Popular Forms

If you believe that this page should be taken down, please follow our DMCA take down process here